inheritance tax waiver indiana

This is the option with the highest tax. The final step is to distribute the assets to the heirs and have probate closed.

Indiana Estate Tax Everything You Need To Know Smartasset

However other states inheritance laws may apply to you if someone living in a state with an inheritance tax leaves you money or property.

. You had dreams of a bright future filled with financial security a dream home travel and maybe even a few kids. This includes filing tax returns and paying taxes. If someone leaves you something from.

You never imagined youd find yourself in the middle of a. A last will and testament is the foundation of an estate plan which lets you plan for your estate after youre goneHowever there are certain things that you might not want to put in your will. The spouse could choose to take an immediate lump sum.

In this situation the beneficiary will owe taxes on the entire difference between what the owner paid for the annuity and the death benefit. 739 the Maryland Estate TaxUnified Credit was signed into law on May 15 2014. How Long Do You Have to File Probate After Death in Arizona.

It maintains its tax-deferred status meaning the beneficiary owes no immediate taxes. Nonetheless Indianas inheritance tax was repealed retroactively to January 1 2013 in May 2013. In Pennsylvania for instance there is an inheritance tax that applies to out-of-state inheritors.

There is no inheritance tax in Indiana either. Indiana Inheritance and Gift Tax. The law repealed and re-enacted Marylands estate tax so the exemption would increase.

In general a last will and testament is an easy and and straightforward way to state who gets what when you die and name a guardian for your minor children. There are a few exceptions to this deadline including timelines for contesting a will or when a. According to Arizona Code 14-3108 probate must be filed within two years of the persons death.

Maines estate tax exemption was recently increased to 587 million for 2021. The day you exchanged vows with your spouse you were ecstatic. This is an option for other beneficiaries as well.

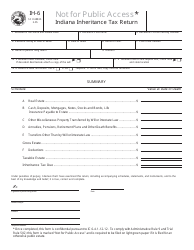

Indiana Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller

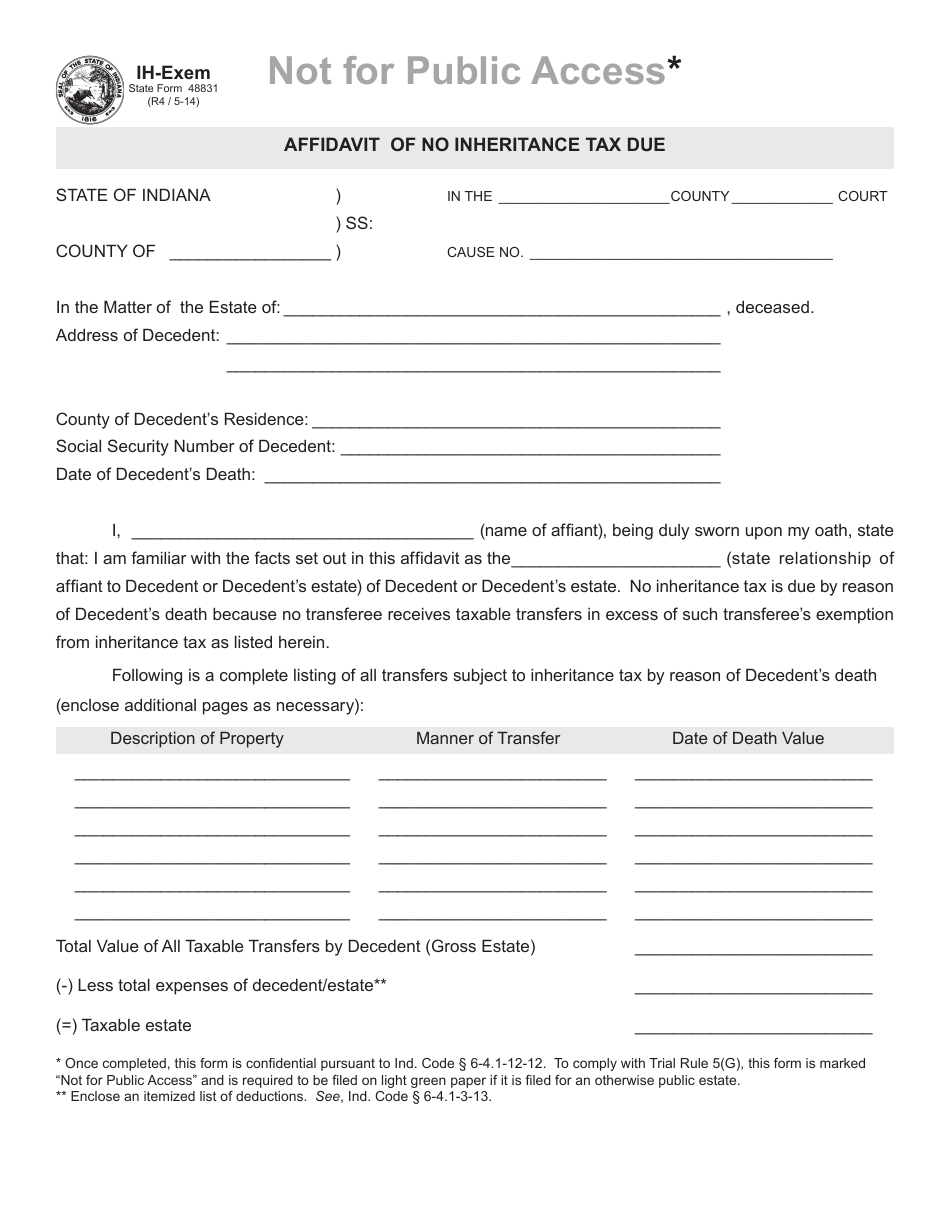

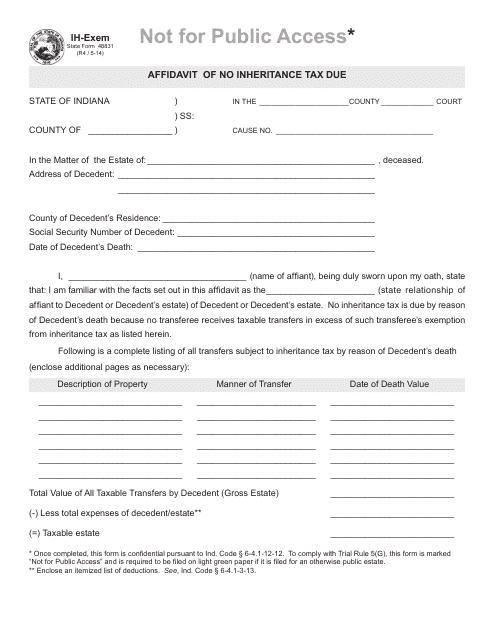

State Form 48831 Ih Exem Download Fillable Pdf Or Fill Online Affidavit Of No Inheritance Tax Due Indiana Templateroller

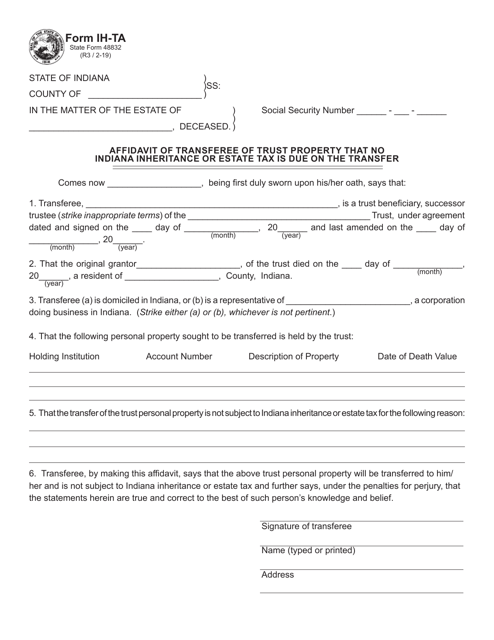

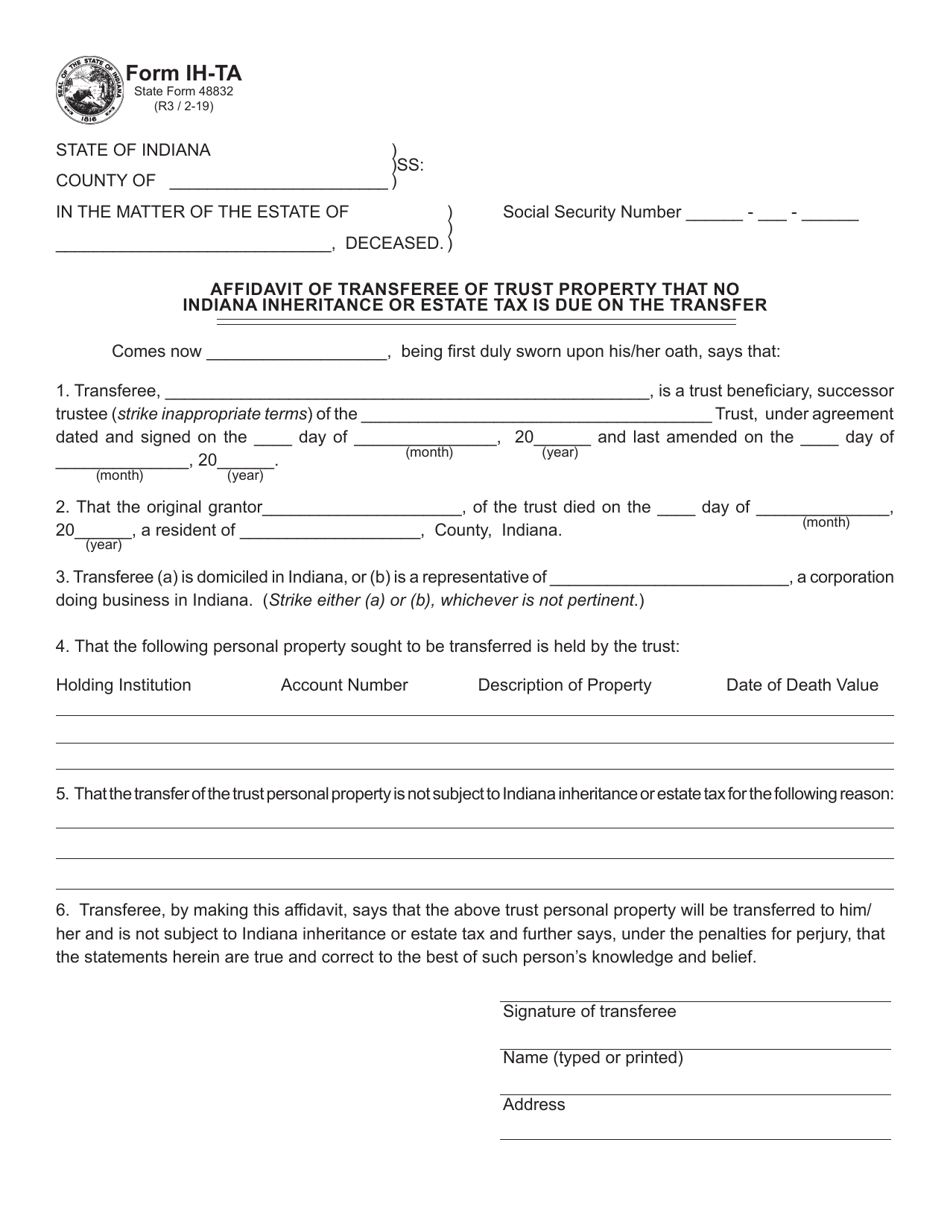

Form Ih Ta State Form 48832 Download Fillable Pdf Or Fill Online Affidavit Of Transferee Of Trust Property That No Indiana Inheritance Or Estate Tax Is Due On The Transfer Indiana Templateroller

Indiana Estate Tax Everything You Need To Know Smartasset

State Form 48831 Ih Exem Download Fillable Pdf Or Fill Online Affidavit Of No Inheritance Tax Due Indiana Templateroller

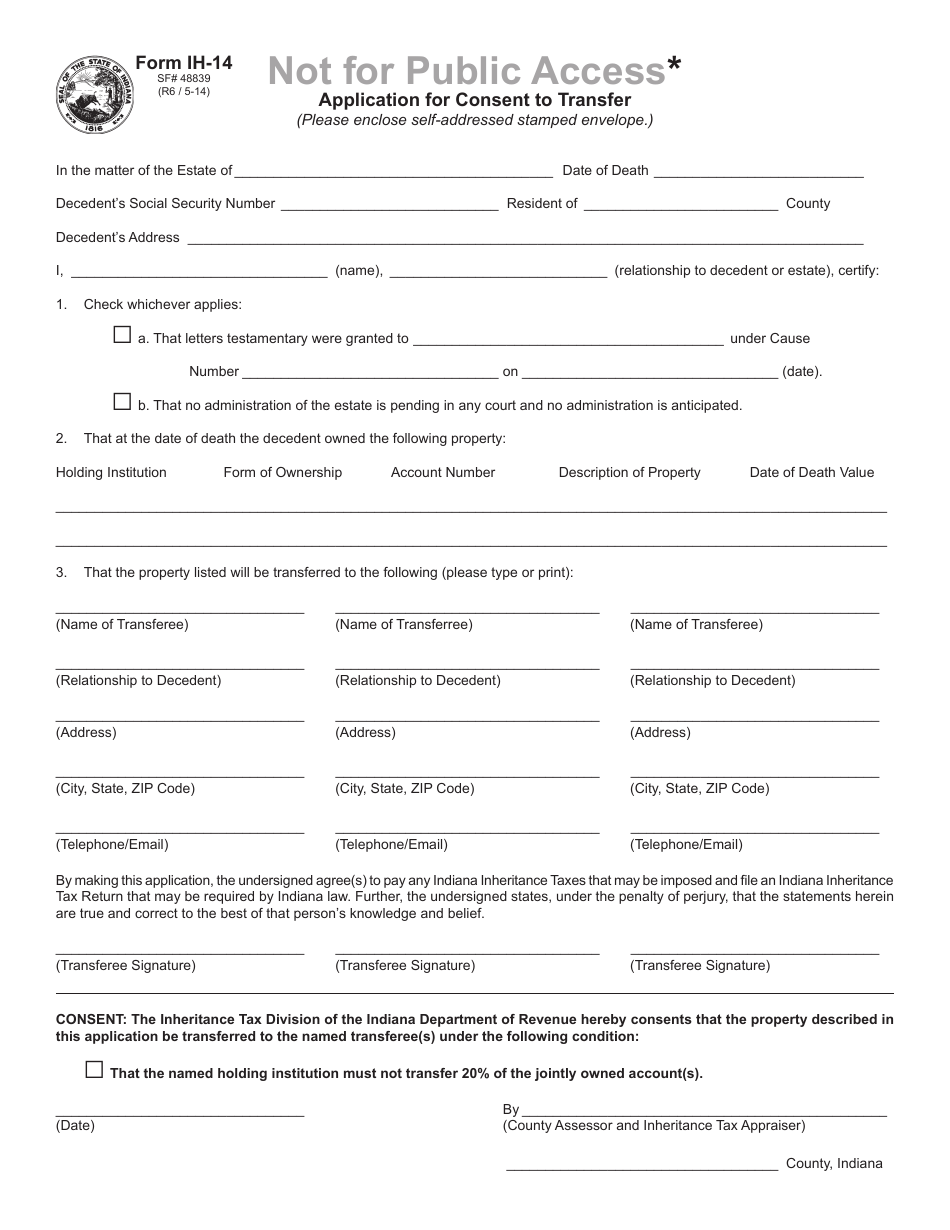

State Form 48839 Ih 14 Download Fillable Pdf Or Fill Online Application For Consent To Transfer Indiana Templateroller

Indiana Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller

Form Ih Ta State Form 48832 Download Fillable Pdf Or Fill Online Affidavit Of Transferee Of Trust Property That No Indiana Inheritance Or Estate Tax Is Due On The Transfer Indiana Templateroller

Fillable Online Ih 6 Not For Public Access Indiana Inheritance Tax Return Fax Email Print Pdffiller